What Is Net Present Value (NPV) in Project Management?

What Is Net Present Value in Project Management?

Net present value (NPV) refers to the difference between the value of cash now and the value of cash at a future date. NPV in project management is used to determine whether the anticipated financial gains of a project will outweigh the present-day investment — meaning the project is a worthwhile undertaking.

Generally, projects or investments with a positive NPV will be profitable and therefore given a green light for consideration, while an investment with a negative NPV will result in a financial loss, and may not be undertaken.

How to calculate net present value

To understand how to calculate NPV, first consider that money is worth more now than it is later. For example, $1,000 today is worth more than $1,000 in three years. Why? Because you could take that $1,000 today and invest it, earning a modest 4% each year. In three years, that $1,000 will be worth $1,124.86. (Note that this does not factor in inflation, which we’ll address momentarily). That means the “present value” of $1,000 after three years of investment is $1,124.86.

Another factor contributing to this dynamic is inflation. Say the inflation rate is 3 percent. If you did not invest your money, your $1,000 would be worth $915.14 in three years. So the “future value” of $1,000 today is $915.14 in three years. These numbers are calculated using the following formula, where PV stands for “present value,” FV stands for “future value,” r stands for the interest rate in decimal format, and n stands for the number of years: PV = (FV)/(1+r)n

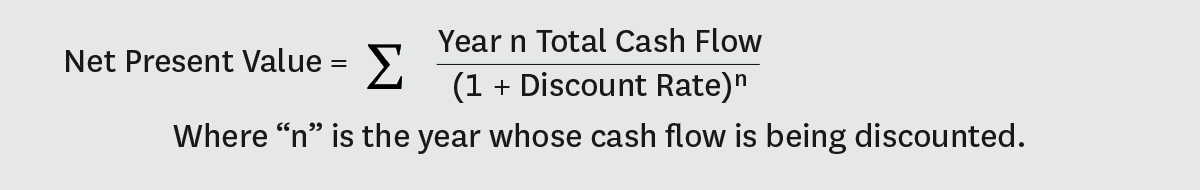

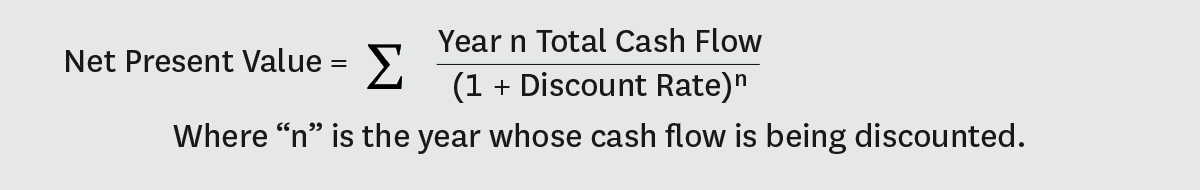

NPV formula

The net present value formula helps to determine the current value of expected cash flows, calculating the time value of money. By using a discount rate and future cash flows at a predetermined rate, the NPV formula assists in assessing if the initial investment is worth it or not.

The equation for calculating net present value is as follows:

Simply put, the net present value is the sum of the present value of cash flows (both positive and negative) for each year associated with the investment, which is then adjusted (the terminology used is “discounted”) so that it’s expressed in today’s dollars.

It should be noted that few project managers calculate NPV by hand; there is an NPV function in Microsoft Excel that will calculate it for you, or you can use a calculator.

Further reading:

- From Surviving to Thriving: 3 Challenges PMOs Need to Conquer Now

- 10 Reasons Projects Fail: Lessons from the Death Star

Artem Gurnov

Artem is a Director of Account Development at Wrike. He previously held the role of Project Manager, overseeing a team of customer success managers (CSMs). Over the years of building teams and scaling business processes, he has successfully deployed multiple projects, from automating client outreach to setting up work prioritization tools for sales reps and CSMs.