Unless you're a whiz with financial mathematics, "amortization schedule" is probably one of those terms that immediately makes your eyes glaze over.

Well, take a few blinks — because an amortization schedule is something you're highly likely to encounter at some point in your life. It's worth understanding (at least at a high level) what it is and how it works so that you can keep a better eye on your money.

Already cringing? Don't worry. We have your simple and straightforward guide to amortization schedules. Here are the details on what these schedules are, why they matter, and how you can create your own.

What is an amortization schedule?

An amortization schedule is a table used to see and track payments on a loan. Put simply, it shows your loan repayment schedule.

The amortization schedule displays your beginning balance, principal, interest, payment amount, and ending balance over the life of the loan. For that reason, you might also hear it referred to as a loan amortization schedule.

What does an amortization schedule look like?

An amortization schedule is actually a pretty simple table with several columns and then a row for every single loan payment you need to make (which is usually monthly with most loans).

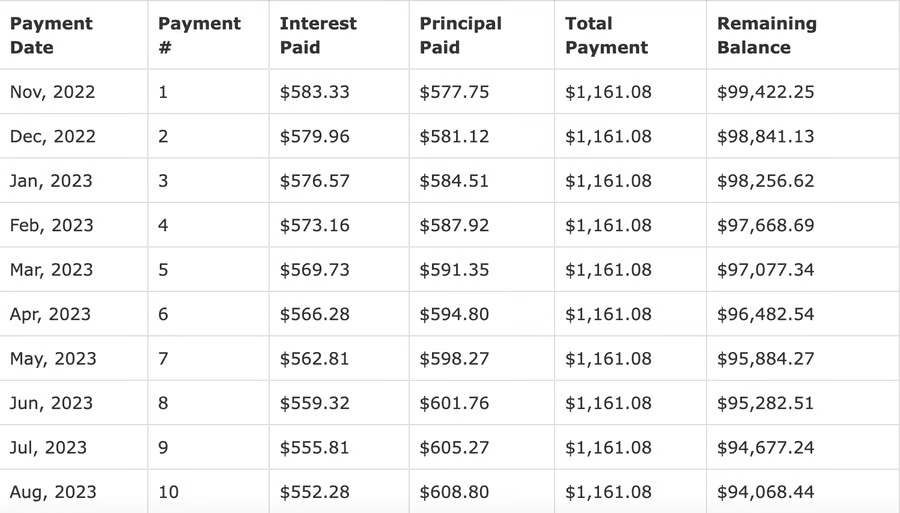

Want to see one in action? Imagine that you're taking out a business loan for new product development. You're taking out $100,000 at a 7% interest rate and will pay it back monthly over the course of 10 years. Here's a quick look at what the first few rows of your amortization schedule would look like:

What can you use an amortization schedule for?

An amortization schedule can be used to display the periodic payments for really any type of loan — whether it's a car loan, business loan, mortgage, or any other type of loan.

When thinking about business loans specifically, you might take out a loan to build a new facility. Or purchase a piece of equipment. Or develop new products. Or really any other purchase or activity that you're unable to finance entirely yourself.

In most cases, your lender will provide you with an amortization schedule or payment schedule so you understand how your monthly payments apply to your outstanding balance and will reduce your loan obligation. If they don't, you can ask them to supply you with an amortization schedule for your loan.

Why is an amortization schedule helpful?

Why even bother creating or referring to this table that's full of seemingly endless digits? There are a few reasons why an amortization schedule is important:

1. Understand the breakdown of your loan

For starters, any time money is involved, it's smart to understand where your dollars are going.

An amortization schedule helps you see how much of your payment is applied to the principal (that's the amount you originally agreed to pay back) and how much goes to interest (which is the extra charge or fee you pay your lender in order to borrow the money).

2. Keep track of your loan payments

Additionally, loan repayment is important — but it's only one of the responsibilities you have on your plate. An amortization schedule is a super easy table you can look at to make sure you're on track with your loan payments so that you can avoid incurring any late fees.

3. Compare loan options

Maybe you haven't gotten a loan yet and are comparing options from several different lenders — who all have slightly different interest rates and loan terms.

An amortization schedule will help you match up those different loans against each other to get a grasp on what your monthly payments would actually look like with each of them.

4. Strategically pay off your loan

Finally, an amortization schedule can help you be more strategic with your payments to pay off a loan faster. For example, let's revisit our $100,000 business loan. The quicker you can pay it off, the less interest you pay — which means you'll spend less money in the long run.

So, if your business is doing well and you have some extra money to put toward your loan repayment, you can specify that you want your additional payments to be applied directly to the principal.

We'll spare you the in-depth math lesson, but that approach lowers your ending balance for that month, which means you'll have a lower beginning balance at the start of the next month. That's a smaller number to multiply by your interest rate, which means you're strategically paying less interest over time.

How to create an amortization schedule: Three steps to follow

Now that you understand the ins and outs of an amortization schedule, there's another big question you need answered: How do you create an amortization schedule for yourself? Here are three steps to help you set up your own table.

1. Know the nuts and bolts of your loan

Before you open any sort of spreadsheet (which is, by and large, the most common and popular approach for creating an amortization schedule yourself), you first need to make sure you have the right information.

Regardless of whether you're creating a business loan amortization schedule, mortgage amortization schedule, or one for any other type of loan, there are four key pieces of information you need. Here's what they are, along with examples that stick with our $100,000 business loan scenario:

- Loan amount: The total amount that you borrowed from the lender.

- Example: $100,000

- Interest rate: The rate that you agreed to with the lender.

- Example: 7%

- Term: The length of time you have to pay back your loan, plus interest.

- Example: 10 years

- Payment cadence: The intervals in which you'll make payments.

- Example: Monthly

2. Understand the amortization formula

Are you ready for a quick math lesson? Here's a look at the amortization formula you could use to calculate your monthly payments manually:

Before you start sweating and having flashbacks to your high school algebra class, here's what all of those numbers and letters mean:

- A = Periodic payment amount (in other words, your monthly payment)

- P = Amount of principal, net of initial payments

- i = Interest rate (make sure to get the interest rate for your term rather than simply using the annual interest rate — for our example, you'd divide .07% by 12 months to get your monthly interest rate for your loan)

- n = Total number of payments (so, if you're paying monthly, you need to multiply the years of your loan by 12)

You need to use the amortization formula to calculate your monthly payment for each month of your loan. So, sticking with our 10-year and $100,000 business loan example, that'd mean you'd need to run this same calculation 120 separate times (that's 10 years times 12 months in each year). Yikes.

But for the sake of an example, here's what the formula would look like if you plugged in the numbers for your $100,000 business loan to get your monthly payment amount.

The good news is that you don't need to whip out the calculator and do all of this manually. You can create a spreadsheet template for yourself. Or there are amortization schedule calculators that will do all of the hard work for you. Don't worry — we'll cover those in detail a little later.

3. Create your amortization schedule

You don't want to have to return to a complicated formula every time you want to get a grasp on your monthly payment and what dollars are allocated where. That's why all of your monthly payment details should get calculated upfront.

Those will then be displayed in your amortization schedule, which should include columns for:

- Month number: Is this the first month you're making a payment? Or the 23rd month?

- Payment date: The date that the monthly payment is due.

- Beginning balance: How much is left on your loan at that point in time.

- Payment amount: How much you owe for loan repayment that month.

- Principal: How much of your payment is principal, meaning the amount going toward the total you originally took out.

- Interest: How much of your payment is interest, meaning the amount going toward the fee to borrow the money.

- Ending balance: How much is left on your loan after that payment.

In the very last row of your amortization schedule, your ending balance should be $0. That means your loan is paid off — and it's time to celebrate.

Again, here are the first few rows of the amortization schedule for our $100,000 business loan we've referenced throughout this guide:

Are there easier ways to create amortization schedules?

It's possible to create an amortization schedule yourself — but that doesn't mean it's practical. In fact, it's a lot of work. That's especially true if you need to calculate the monthly payments for a longer-term loan. If you're paying your loan back over the course of 30 years, that's 360 monthly payments and spreadsheet rows you need to calculate.

Fortunately, there are a couple of other ways to create amortization schedules that involve little to no elbow grease on your end.

1. Use an amortization schedule template

A spreadsheet tool like Excel is one of the most popular solutions for creating an amortization schedule. Excel makes it even easier with a loan amortization schedule template.

With the templated amortization schedule, Excel simply requires that you enter your basic loan information like your loan amount, annual interest rate, loan period in years, number of payments per year, and the start date of your loan.

Punch in those details and Excel will take it from there to create a simple and helpful amortization schedule for your loan.

2. Use an amortization schedule calculator

There's an even easier way to get your amortization schedule: use an online amortization schedule calculator.

Much like the Excel template, you simply need to enter in your basic loan information and it'll generate the schedule for you. Except you don't even need to go so far as to download a template or open a spreadsheet.

Here are a few popular and reliable amortization schedule calculators to check out:

- https://amortizationschedule.org/

- https://www.amortization.org/

- https://www.loanamortizationschedule.org/

- https://www.bankrate.com/mortgages/amortization-calculator/

Wrike can streamline financial planning for your business

The simple mention of an amortization schedule might make your eyes glassy — and, in all honesty, the process of creating it entirely yourself can be pretty daunting and tedious. A template or calculator are the far faster and easier ways to go.

However, even with your amortization schedule sorted out, there are plenty of other financial aspects you need to manage for your team or business. Wrike can help you stay on top of your resources and your finances with features like:

- Customizable hourly rates

- Project scoping and budgeting

- Spend monitoring

- Reports and real-time data

- Integration with Excel so you can easily import and export spreadsheets

Whether it's loan repayment, project budgets, or billable hours, you don't want to leave any element of your business' finances up to chance. Wrike eliminates the guesswork and helps you keep a close eye on all of your numbers — even if your eyes are admittedly still a little glazed.

Ready to bring some order to your business' finances and projects? Start your free trial of Wrike today.